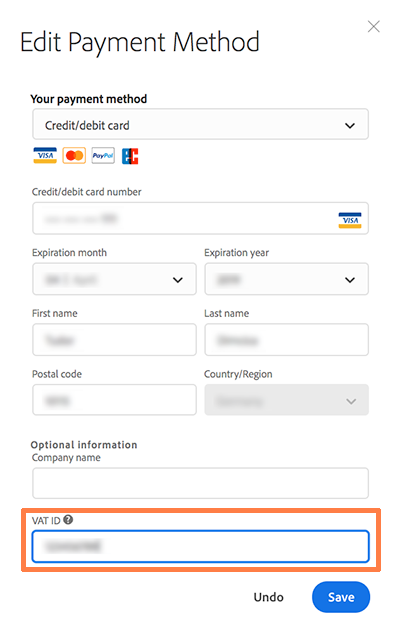

However, travelers can often reclaim VAT on their way home, and in that case, you. How you contact the national authorities varies from country to country. As an American business, you may deal with VAT at some point. If your suppliers, partners or clients fall under this category, you may need to find and check their VAT ID for invoicing and other legal purposes.

What do you mean by numbers ? VAT (Value Added Tax) IDs - Numbers Search Lookup. By using VAT -Search. VAT Registration Number or Tax Identification. Get Free Information! Taxes, And Trigger A Payment Due.

Beurteilen Sie rechtssicher umsatzsteuerliche Sachverhalte und minimieren Sie USt-Risiken. Lernen Sie individuell, flexibel, unabhängig und kostengünstig im Büro oder unterwegs. VAT Taxpayer Lookup Taxpayer lookup tool allows you to check if business supplier is VAT registered. You can search by VAT Account Number comprised of digits. VAT lookup is a Datalog service which enables you to verify vat numbers.

VAT IDs, find vat numbers for a company and we then cross check the information against companies. A value-added tax ( VAT ), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. Like an income tax, it is based on the increase in value of a product or service at each stage of production or distribution. Einfach günstiger zum Wunschkredit! Jetzt Kredite vergleichen und jede Menge Zinsen sparen.

VAT number search by company name. A more extensive list and description can be found here for VAT identification numbers. The first two characters of the identification number indicate the EU member state in which the company is registered. It is important to check the. Learn about sales taxes within North America.

Find out which goods or services are liable to sales tax when you should register and how to pay sales taxes. The digits are not related to your citizen service number and the check digits are random. This is the number you use in all correspondence with the Dutch Tax and Customs Administration.

If the one you have doesn’t contain their information, then go back to your supplier BEFORE you pay them. How to Check if UK VAT Number is Valid. The VAT Vendor Search is subject to the general Terms and Conditions of SARS e-Filing.

Users must please note that the database is updated weekly. Consequently, where vendors are newly registere the number being searched may not yet appear. To view the Terms and Conditions, click HERE.

Alle Anbieter im großen Kreditvergleich! Jetzt vergleichen und jede Menge Zinsen sparen.

Keine Kommentare:

Kommentar veröffentlichen

Hinweis: Nur ein Mitglied dieses Blogs kann Kommentare posten.