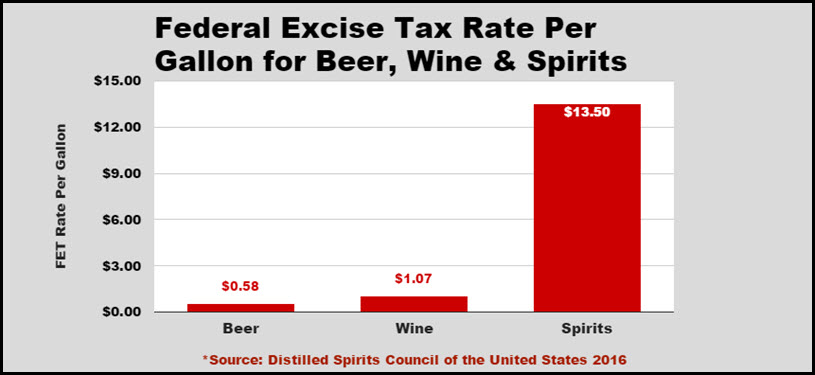

In New Mexico, the state charges an excise tax of $6. This brings the total excise tax to $19. The state also adds excise taxes of cents to beer and $1. Sweeping Changes to Federal Excise Taxes for Alcohol Beverages Last week, President Trump signed a new, sweeping alcohol beverage excise tax reform into federal law.

Eligibility for exemption is. BevTax alcohol tax calculator. Federal excise tax and state excise tax for beer, wine and spirits. Liquor tax for all states in the USA.

Accurate automatic calculations for all tax rates for multiple unit sizes. Bevtax is a sophisticated excise tax calculator for the alcoholic beverage industry. This tax is simply an excise tax applied to each pack of cigarettes. Specifically, the federal government uniformly charges an excise tax of $1.

On top of the federal tax , all states levy a different cigarette tax that ranges from $0. Unlike other excise taxes collected by the IRS, alcohol and tobacco taxes are collected by the Alcohol and Tobacco Tax and Trade Bureau of the US Treasury Department. Alcohol Excise Taxes Excise tax revenue from alcoholic beverages amounted to $9.

Reduced rates of excise duty on beer containing more than 2. For more information on applying for a cannabis licence, go to Cannabis duty. Excise duty is imposed under the Excise Act on beer produced in Canada. The current IRS Form 8is not related to excise tax. This Tax Alert provides a summary of these significant changes to wine, beer and spirits excise taxes.

The new law now provides much-needed relief for America’s brewers and beer importers, an industry that today supports more than 2. American jobs and generates more than $3billion in. If the kombucha product reaches an alcohol content of at least 0. This is true even if the finished product has less than 0. The first federal tax on gasoline was a penny per gallon. Since it was first adopte the federal gasoline excise tax has funded the Highway Trust Fun removal of leaking underground fuel storage tanks, reduction of the national debt, alternative methods of transportation and creation and upkeep of recreational trails. Alcohol Taxes and Duties Alcohol Taxes and Duties Legislative Framework. Generally, alcohol was previously taxed pursuant to the Excise Act.

Excise rates for alcohol are indexed twice a year, in line with the consumer price index (CPI) – generally on February and August. A tax of $per proof gallon would equal about cents per ounce of alcohol. The tax on a six-pack of beer would jump from about cents to cents, and the tax on a 750-milliliter. Unlike a sales tax , an excise tax is usually a fixed amount (not a percentage of the purchase price), and excise taxes are only collected on the sale of specific taxable products rather then on all sales made within the state. CRS Report for Congress Federal Excise Taxes Imposed on Alcohol Products Louis Alan Talley Specialist in Taxation Government and Finance Division Pamela J. Jackson Analyst in Public Sector Economics Government and Finance Division Summary This report provides a brief history of federal alcohol excise tax rates and examines recent federal.

The spring edition of the federal government’s semi-annual Unified Agenda of Federal Regulatory and Deregulatory Actions (Regulatory Agenda) has been published. Like other federal agencies, the Alcohol and Tobacco Tax and Trade Bureau (TTB) uses the Regulatory Agenda to report on its current rulemaking projects. Excise tax calculations and liability must be determined for each taxpayer based on numerous variables.

Temporary tax relief is available for. For imported beer, the person subject to customs is liable to pay the beer excise tax. Tax liability arises at the time the beer enters free circulation under customs law. The beer excise tax is assessed in accordance with the strength of the beer (° Plato), on the basis of the original gravity.

An excise tax is a legislated tax on specific goods or services at purchase such as fuel, tobacco, and alcohol. Businesses required to register for excise tax. Excise taxes are intranational taxes imposed within a government infrastructure.

Under the UAE Federal Decree Law No.

Keine Kommentare:

Kommentar veröffentlichen

Hinweis: Nur ein Mitglied dieses Blogs kann Kommentare posten.